Total cost of ownership: turning insight into strategy

Published 17/02/26 | Read time 14 min

Total cost of ownership: turning insight into strategy

Published 17/02/26 | Read time 14 min

For many fleet operators, vehicle costs appear to begin and end with acquisition. Whether that's the purchase price or a monthly lease payment. It's the number procurement teams negotiate, the figure budget holders scrutinise, and the metric most used to compare vehicles.

But experienced fleet managers know that upfront cost is only the starting point. The real financial impact unfolds over years of fuel use, maintenance, compliance, downtime and, eventually disposal or end-of-contract charges. This long-term financial footprint is the Total Cost of Ownership (TCO) and it's critical for building an efficient, profitable and future-proof fleet.

TCO is not simply a calculation - it's a way of thinking.

A shift from short-term cost awareness to long-term cost intelligence. It helps fleets understand not just what they spend, but why they spend it, where the pressures lie, and how today's decisions influence tomorrow's margins. When used well, TCO shapes procurement, strengthens operational planning, improves bidding accuracy, and future-proofs fleets against rising costs and regulatory change.

Why TCO matters more than ever

The cost environment facing fleets is more complex now than ever before. Supply chain pressures have extended lead times and pushed up acquisition costs, whether capital purchases or monthly lease rentals. Fuel prices fluctuate unpredictably. Fleet managers must understand the cost of running EVs where previously it was just diesel vs petrol. Vehicles themselves are becoming more technologically advanced, and therefore more expensive to maintain and repair. Meanwhile, regulatory requirements continue evolving, adding new layers of compliance.

In this context, relying on headline costs or historical assumptions is risky. A vehicle appearing cost-effective on paper may drain resources once real-world usage, fleet maintenance patterns, and funding structures are factored in. Conversely, a higher-priced option may deliver exceptional long-term value. TCO reveals the true financial impact, helping fleets protect margins, avoid surprises, and plan with confidence.

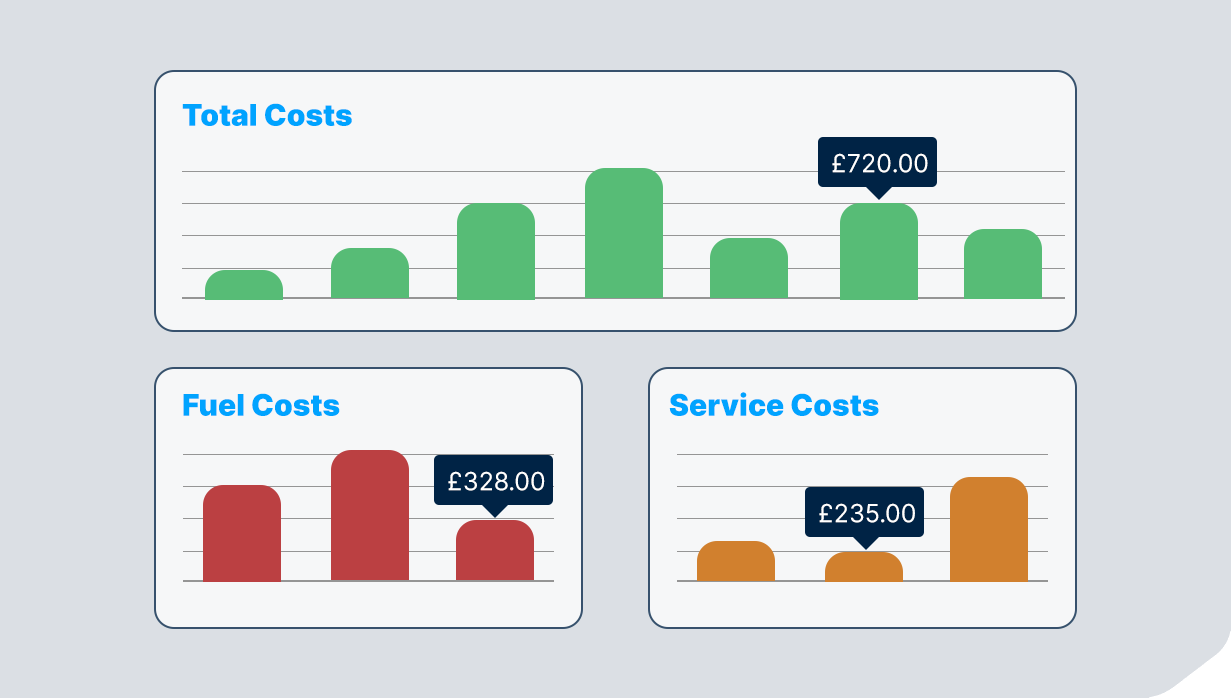

![]()

What goes into TCO?

At its core, TCO represents all costs from acquisition through to disposal:

- Purchase price or lease payments

- Depreciation or rental profile

- Fuel

- Service, maintenance and repair (SMR)

- Insurance

- Tax

- Disposal value or end of contract charges

But the real challenge lies in the grey areas, and every fleet must decide where to draw the line. Consumables like AdBlue, screen wash, and bulbs add up across large fleets. Road use charges such as tolls, congestion zones, low emission zones, and parking can be significant for urban operations.

Driver-related costs such as fines, damage repairs or additional SMR costs because of harsh driving are contentious -- are they vehicle costs or behavioural issues? Telematics subscriptions, downtime, and EV infrastructure all influence TCO but aren't always tracked.

There's no universal right answer. The key is consistency and clarity of purpose.

The TCO formula

While every fleet's TCO model will include different components depending on purpose, there's a useful framework for thinking about vehicle costs:

TCO = Standing Costs + Running Costs – Residual Value

Standing costs are essentially fixed - they don't change significantly based on how much you use the vehicle:

- Depreciation (or lease rental)

- Insurance

- Vehicle excise duty (VED)

- Interest (if the asset is purchased using credit)

- Inspection costs (PMI, MOT, annual inspections)

- Telematics subscriptions and tachograph analysis

Running costs are variable - they're directly influenced by mileage, driver behaviour, and how vehicles are used:

- Fuel

- Service, maintenance and repair (SMR) including consumables

- Parking, tolls, and penalty charge notices (PCNs)

This distinction matters because it helps you understand where you have control. Standing costs are largely determined at procurement and require strategic decisions to change. Running costs respond to operational improvements - better driver training, route optimisation, preventive maintenance. Fuel is typically the largest of these, and for fleets looking to take a more strategic approach, our Insight on navigating rising fuel costs explores this in detail.

Understanding this split also helps when comparing funding methods. Contract hire bundles many standing costs into a single monthly payment. Outright purchase separates them, giving you more visibility but also more responsibility to track each element.

Different TCO models for every fleet objective

TCO is not a single calculation. It's a flexible framework adapted to different objectives. The components you include depend entirely on what you're trying to achieve.

Procurement-focused TCO

Used when comparing vehicles before further acquisition or replacement, this approach focuses on inherent vehicle costs rather than operational variables. Crucially, it compares funding methods such as outright purchase, contract hire, finance lease and other structures. A procurement model considers purchase price versus monthly rentals, depreciation versus residual value risk, interest rates, SMR packages included in leases, predicted fuel use, and expected SMR costs. It deliberately excludes driver behaviour or route-specific costs because these vary independently of the vehicle. This model is ideal for comparing ICE versus EV, different manufacturers, or different funding methods for the same vehicle.

Operational TCO

Operational TCO takes a broader view, aiming to understand real-world running costs day to day. This approach helps fleets identify cost drivers, improve efficiency, and reduce avoidable spend. It includes driver behaviour impacts, route-specific costs, downtime, SMR costs, telematics, consumables, parking, tolls, and access charges. It provides an accurate picture of how vehicles perform in practice rather than theory.

Commercial TCO

Some fleets, particularly in logistics, use TCO as a commercial tool. They calculate cost per mile, cost per drop, or cost per route, feeding this data directly into pricing and bidding. This ensures contract pricing reflects the true cost of delivering work, protecting margins and preventing under-quoting. In these cases, TCO becomes business-critical -- not just a fleet management metric.

Which approach is right for you?

Choose based on your primary objective:

| Your primary goal | Recommended TCO approach |

|---|---|

| Comparing vehicles before purchase or deciding between funding methods | Procurement TCO: Focus on inherent vehicle costs. Exclude operational variables like driver behaviour. |

| Improving efficiency, reducing downtime, or identifying cost outliers | Operational TCO: Include driver behaviour, route costs, downtime, telematics, consumables. |

| Setting contract pricing or bidding for logistics work | Commercial TCO: Calculate cost per mile/drop. Feed into pricing models. |

TCO in practice: real-world examples

To bring these concepts to life, here are three examples that show how typical fleet operators could use TCO to drive different outcomes:

Regional construction contractor: Procurement TCO

A regional construction contractor operating 30 vans across the Southwest faced a familiar challenge: balancing upfront costs against long-term value when replacing ageing vehicles. The fleet manager knew cheaper purchase prices didn't always mean lower lifetime costs but needed data to prove it.

They built a procurement TCO model comparing three shortlisted vans over a typical five-year ownership cycle, including purchase price, depreciation based on manufacturer residual value guides, predicted fuel consumption using WLTP figures adjusted for real-world usage, expected SMR costs from manufacturer service schedules, insurance quotes, and VED. The model excluded operational variables like driver behaviour to ensure fair comparison between vehicle specifications alone.

The analysis revealed the mid-priced option delivered the lowest TCO -- 8% better than the cheapest alternative over five years. Superior fuel economy and lower predicted SMR offset the £2,400 higher purchase price within 30 months. Armed with this evidence, the business confidently invested in quality rather than chasing the lowest headline price, knowing the decision would protect margins long-term.

National vending machine supplier: Operational TCO

A national vending machine service business operating 200 vans noticed some vehicles consistently cost more to run than others but couldn't pinpoint why. They implemented an operational TCO model tracking real-world costs: actual fuel consumption via fuel cards, SMR invoices, tyre replacements, downtime measured in days off road, telematics data revealing driving patterns, and PCN costs allocated per vehicle.

Within three months, patterns emerged. High-cost vehicles clustered in specific urban regions where aggressive driving, frequent stopping, and congestion drove up fuel consumption by 23% compared to rural routes.

Armed with this insight, the business acted: targeted driver coaching reduced harsh braking incidents by 40%, route optimisation reduced city-centre mileage, and two problem vehicles were reallocated to motorway-heavy routes where they thrived. TCO for the worst-performing quartile dropped 18% within six months.

The operational model didn't just measure costs -- it identified exactly where money was being wasted and enabled precise interventions. What started as a reporting exercise became a continuous improvement tool.

National home improvement company: Commercial TCO

A national home improvement company operating 600 vans across installation and delivery services was losing money on certain contracts without understanding why. They suspected vehicle costs were higher than their pricing models assumed but lacked granular data.

The fleet team implemented a commercial TCO approach, calculating cost per mile for every vehicle and allocating costs by contract. They tracked lease rentals, fuel management, SMR, insurance, telematics, consumables, tolls and, critically, downtime costs including lost revenue and replacement hire.

The analysis was stark. Installation contracts involving frequent urban work showed vehicle costs 34% higher than national delivery contracts using motorway networks. Congestion, parking costs, and stop-start wear were invisible in their pricing. Worse, three major contracts were priced at margins assuming £0.42 per mile when true costs averaged £0.58.

Armed with accurate TCO data, the business renegotiated contract rates, declined unprofitable renewal opportunities, and restructured pricing for new bids. Within 12 months, fleet-related margin leakage reduced by an estimated £340,000 annually. TCO transformed from a fleet metric into a commercial decision-making tool protecting the entire business.

Red flags to watch

- Wildly different TCOs for similar vehicles -- investigate data quality or operational problems

- Sharp upward TCO trends unexplained by mileage or age -- suggests SMR issues or driver behaviour problems

- Procurement decisions proving consistently wrong -- your model is missing key variables

- Data gaps or estimates -- assumptions undermine accuracy

- Model not updated in over a year -- outdated benchmarks produce outdated conclusions

- No one outside finance understands it -- TCO unable to influence decisions

Starter frameworks

Essential components for each approach:

| Approach | Essential components | Key add-ons |

|---|---|---|

| Procurement | Purchase/lease, depreciation, predicted fuel, expected SMR, inspection costs (PMI/MOT) insurance, VED. | EV infrastructure, interest rates, manufacturer incentives, tyre projections. |

| Operational | All procurement components plus: actual fuel, actual SMR, downtime, telematics, driver costs. | Consumables, tolls/parking, replacement hire, route optimisation, driver training impact. |

| Commercial | All operational components plus: cost per mile, cost per drop, route allocation, contract assignments. | Lost opportunity costs, SLA penalties/bonuses, customer requirements, backhaul costs. |

What to do next: your 4-week TCO action plan

Reading about TCO is one thing; implementing it is another.

Here's a practical four-week action plan:

Week 1: Define and scope

Choose your primary TCO objective. Write one clear sentence describing what you want TCO to achieve. Share it with finance, operations, and procurement leads. If they all understand and agree, proceed.

Select 3-5 pilot vehicles with good data quality, varied usage, and different funding structures. Map where your data currently lives -- acquisition costs, fuel, SMR, mileage, downtime, etc. Identify who owns each data source and how frequently it is updated.

Week 2: Gather and validate

Pull 12 months of data together for pilot vehicles. Extract acquisition costs, mileage, fuel spend, SMR invoices, insurance, VED, and other relevant costs but don't worry if some data is incomplete. Just note the gaps so the data can be added later or the record keeping system can be improved to reduce future data gaps. Check for quality issues: missing records, duplicates, implausible values. Clean data or flag for follow-up. Poor data quality is why most TCO models fail. Decide what to exclude initially -- if you can't reliably track downtime or telematics yet, leave them out.

Start simple and accurate.

Week 3: Build and test

Create a basic calculator using a spreadsheet or fleet management software. The formula is straightforward:

Calculate both total TCO and cost per mile. Sense-check the results against expectations and industry benchmarks. If a vehicle's TCO seems wildly wrong, investigate whether it's a genuine operational issue or a data error. Share draft results with stakeholders and ask: Does this make sense? What's missing? What would make it more useful?

Week 4: Take action

Identify one quick win from your analysis and act on it.

Is one vehicle significantly more expensive than expected? Flag it for early disposal. Is a lease actually costing more than ownership? Investigate alternatives. If the pilot worked, expand it to include 10-20% of the fleet. Schedule quarterly reviews to update with fresh data and track cost trends. Investigate automation through fleet management software to avoid manual data-pulling.

Don't aim for perfection on day one -- the goal is progress. A basic TCO model built on reliable data that informs one good decision beats a complex model that never gets implemented.

Start small, prove value and build from there.

Building a robust TCO model

A strong TCO model requires clear thinking, disciplined data collection, and shared understanding across the business. Many fleets begin with good intentions but end up with models that are either too simplistic to be useful or too complicated to be trusted.

Define your purpose and objectives first.

A TCO model built to compare funding methods will look very different from one designed for operational efficiency or commercial bidding. Without a clear purpose, the model will likely become a catch-all that answers every question poorly.

Gather data from multiple sources: finance teams for acquisition and funding; operations for mileage, utilisation, downtime; SMR providers for repair history; fuel card suppliers for consumption; telematics for driver behaviour and routes. The more fragmented the data, the harder it will be to build a model that accurately reflects reality. This is why many fleets turn to systems like FleetCheck that centralise data and provide a single source of truth. A comprehensive fleet management system can track all standing costs - from depreciation schedules and inspection due dates to insurance renewals and telematics subscriptions - alongside running costs like fuel consumption, SMR invoices, and parking charges, making TCO calculation automatic rather than manual.

Decide what to include based on your purpose.

A robust TCO model isn't one that includes everything -- it's one that includes the right things.

The key to success is consistency. A model including tolls for one vehicle but not another, or that treats downtime differently across the fleet, will produce misleading results. Consistency turns your data into real actionable insight.

For owned vehicles, depreciation is often the largest cost. For leased vehicles, that will be rental profile, interest rates, and assumptions about residual values. Your model must reflect these differences accurately. Too many fleets compare owned and leased vehicles using the same cost structure, leading to distorted conclusions.

Ensure your calculations use actual data, not assumptions.

Recognise that vehicles will age, duty cycles will change, and costs will evolve. A TCO model not regularly updated becomes less useful monthly. The most effective fleets treat TCO as a living model that is reviewed quarterly or annually, not a one-off exercise. Make it transparent so decision-makers understand not just the final number but how it was reached. Most importantly, make it actionable. TCO should inform decisions, not just describe costs.

The strategic power of TCO

TCO supports smarter procurement, sharper benchmarking, early identification of cost outliers, and confident electrification strategies. Some fleets compare vehicle batches to reveal manufacturing differences or model-year improvements. Others use it to understand why certain vehicles cost more, pinpointing whether it's duty cycle, driver behaviour, route profile, or mechanical condition. For logistics operators, accurate pence-per-mile figures feed directly into bidding, ensuring pricing reflects reality.

The future of TCO

As fleets become more connected, TCO is evolving from retrospective calculation to predictive tool. Telematics, AI, and integrated systems can now forecast maintenance needs, model fuel consumption, estimate battery degradation, and simulate duty cycles - all of which turns TCO into a proactive decision-making engine.

Conclusion

Vehicle TCO is far more than a spreadsheet. It's a strategic framework helping fleets understand true asset costs, avoid surprises, and make decisions protecting margins and supporting growth. The fleets that embrace TCO don't just know what vehicles cost. They know why, how to reduce costs, and how to use that insight to build stronger, more resilient operations. In a world where every penny counts, TCO isn't just a calculation. It's a cornerstone of modern fleet strategy.